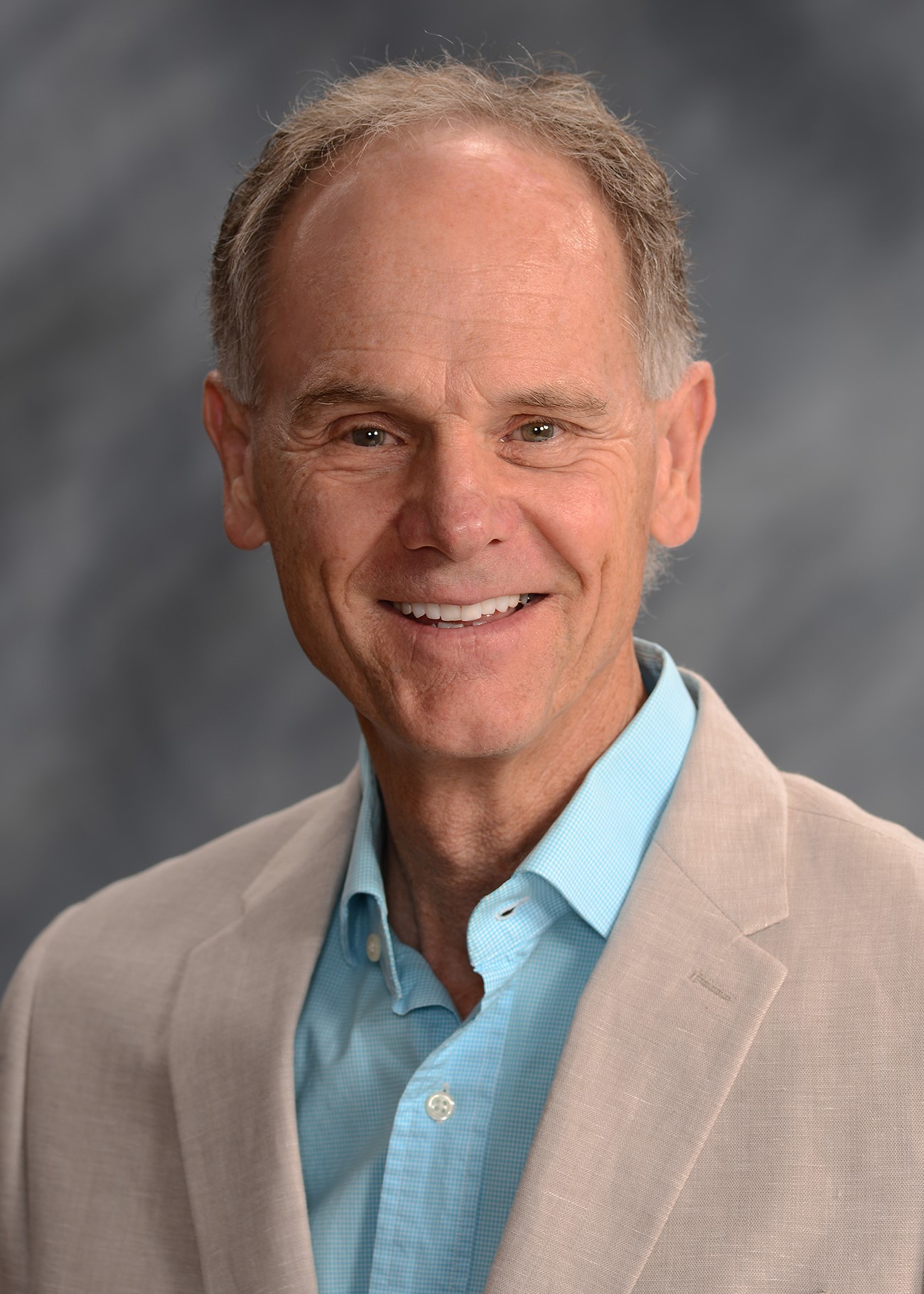

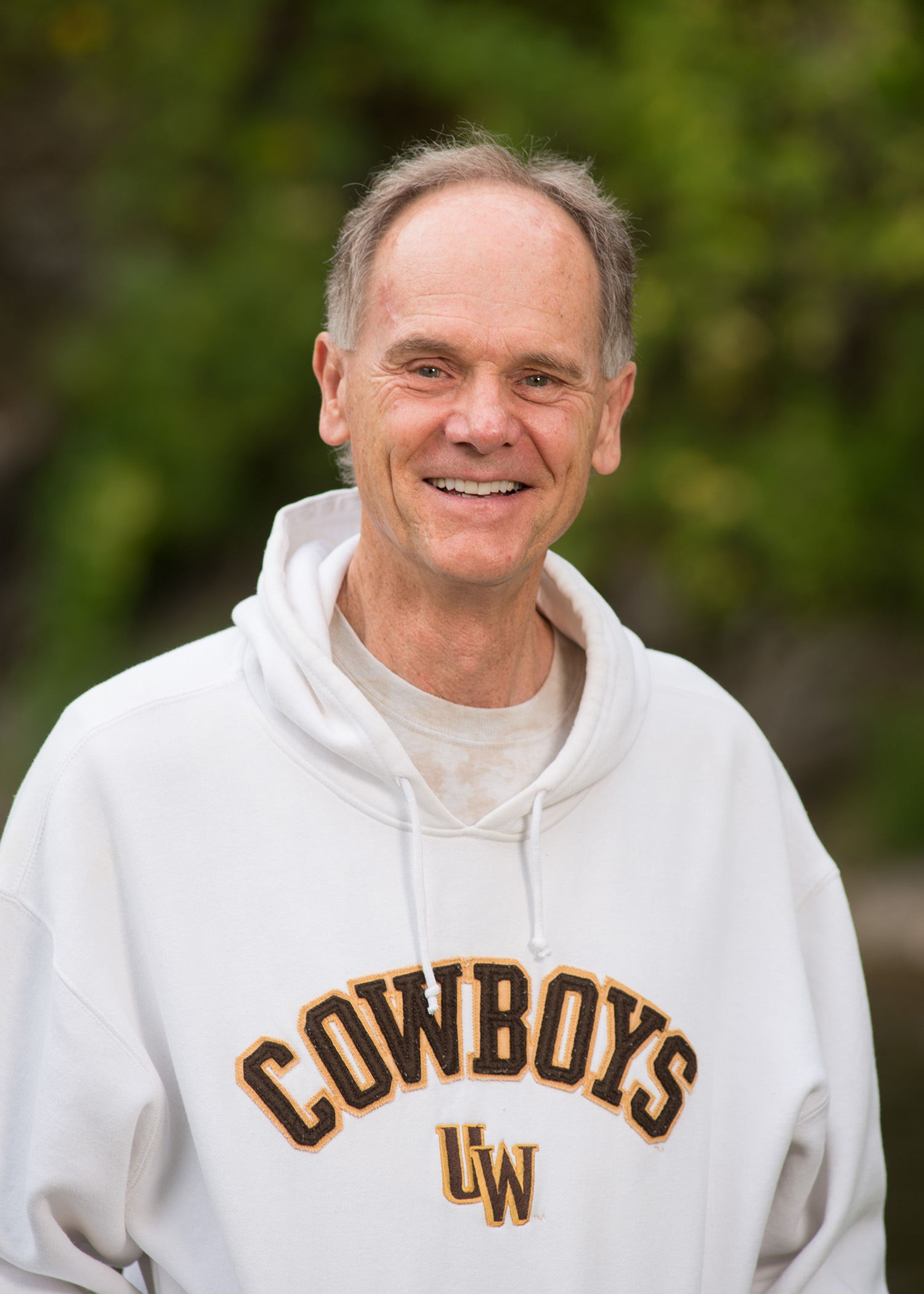

Dean Henzlik: The Medicare Caddy

Medigap

Medigap is traditional Medicare Supplement Insurance. Medicare was built as a cost-sharing program. Both Part A (Hospital) and Part B (Outpatient) have deductibles and co-insurance that you are expected to pay. Further, with Medicare there is NOT a “maximum out-of-pocket” protection. Medigap coverage is designed to protect you from these risks to your financial security.

Part C

Part C of Medicare was passed by Congress in the 1990’s with the intent to give more “choices” in the marketplace. You must have both parts A & B to be eligible for these plans. Only private companies offer these plans. Part C stands for “choice”. You should also think of another “C” word when considering these plans: “Carefulness”. Your Medicare Caddy also emphasizes that clients need to be “careful” in these choices. Rely on the Medicare Caddy to explain the important facts.

Cost Plans

Cost Plans are built on another law passed in the late 1990’s. Cost Plans are best described as a hybrid of both Medigap and Medicare Advantage. A unique feature only found in Cost Plans is the opportunity to move among different plans on a monthly basis.

Part D

Prescription drug plans in Medicare change every year. It is an art form to choose wisely. Rely on the experience and knowledge of the Medicare Caddy to keep your plan costs under control.

Get The Medicare Plan That’s Right for You

Healthwise Rapid City is a locally-owned independent insurance agency. Our mission is to educate and enroll clients in Medicare plans that are most suitable to your situation. We never charge fees. Our operating income is solely derived from enrollment payments made to us by the insurance companies that we place your business with. You pay nothing extra for our continuing help.

Expect this from our approach:

• Educate about Medicare….What it is and what it isn’t.

• Make sure you understand the rules…there are penalties to avoid, especially at the start.

• Help us help you…healthcare concerns, travel patterns, budgets…Best outcomes are achieved when we know your expectations.

• We are here for you…ongoing availability to serve as things change…as they always do.

Change is inevitable! The Medicare Caddy knows the course and how to advise you to adjust “as the weather changes”

Dean Henzlik, CSA

The Certified Senior Advisor (CSA®) is the leading certification for professionals serving older adults. The CSA certification validates and gives confidence to both CSA professionals and the clients they serve.

What We Offer

- Part A

- Part B

- Part D

- Medigap Policies

- Part C

- Long Term Care

Part A

Medicare Part A (Hospital Insurance): Part A coverage is a premium-free program for participants with enough earned credits based on their own work history or that of a spouse at least 62 years of age (when applicable) as determined by the Social Security Administration (SSA).

Our Approach

For everyday care or life-changing care, you can count on us and loved.

Providers

You can count on us to keep you and your loved ones safe and healthy.

Part B

(Outpatient and Medical Insurance): Part B coverage requires a monthly premium contribution. With limited exception, enrollment is required for members who are retired or who have lost Current Employment Status and are eligible for Medicare.

Our Team

Override the digital divide with additional clickthroughs.

Doctors

Nanotechnology immersion along the information highway will close.

Part D

(Prescription Drug Insurance): Part D coverage is not required for plan participants enrolled in any of the state programs (i.e., CIP, TRIP, LGHP or State). Medicare Part D coverage requires a monthly premium, unless the participant qualifies for extra-help assistance.

Our Location

For everyday care or life-changing care, you can count on us and loved.

Dr CV

Quickly maximize timely deliverables for real-time schemas.

Medigap Policies

Medigap is Medicare Supplement Insurance that helps fill “gaps” in Original Medicare and is sold by private companies. Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like:

– Copayments

– Coinsurance

– Deductibles

Our Approach

For everyday care or life-changing care, you can count on us and loved.

Providers

You can count on us to keep you and your loved ones safe and healthy.

Part C

A Medicare Advantage Plan (like an HMO or PPO) is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by private companies approved by Medicare.

Contact Us

Keeping your eye on the ball while performing a deep dive on start.

Protection

Override the digital divide with additional clickthroughs from DevOps.

Long Term Care

Long-term care is a range of services and support for your personal care needs. Most long-term care isn’t medical care. Instead, most long-term care is help with basic personal tasks of everyday life like bathing, dressing, and using the bathroom, sometimes called “activities of daily living.”

Doctors

Nanotechnology immers along the information highway will close.

Our Team

Override the digital divide with additional clickthroughs.

Latest Blog Posts